We are delighted to share a recent market update from our investment partners at Albermarle.

The lessons of history and a tantalising glimpse of recovery

Today, being a stockmarket investor is like being the skipper of a ship. You are below deck, the hatches are battened down and the wind and rain are battering your boat. Yet through a crack to the side of a porthole, you can see in the distance a ray of sunlight breaking through the black storm clouds. The most experienced sailors may even be able to detect a pattern in the ripples of the distant sea and see calmer waters emerging.

To be optimistic at times like this is challenging, but it is also one of the vital skills of investment. History teaches us that each and every year, you are faced with an avalanche of negative news.

This news can of course lead to sharp falls in stockmarkets, and yet somehow through it all, eventually the relentless march upwards for shares is resumed. It is almost always possible to identify a perfectly good reason why markets will fall. Imagine picking a year at random from the last twenty.

You would find a crisis in each one; 2013 (for example) brought a taper tantrum as central banks began to reduce their support for the economy. In 2016 it was the Brexit vote and a US election. Not forgetting 2003 and the war in Iraq, or 2011 seeing the downgrade of US government debt for the first time in history. Actually there is a year that sort of breaks the pattern. Not much went wrong in 2006, although Pluto was downgraded as a planet which was bad for astronomers.

The crises of this year are equally real as all of these earlier ones, as central banks around the world grapple with the need to force down inflation.

The impact of this particular crisis has been worse than any other year in the last 100 because it has led to a co-ordinated fall in both shares and bonds. The only other year where this has happened was 1969. It is a hugely unusual event, but it does not in itself mean that this crisis will be any less likely to be thrown off by markets in the medium-term.

But back to that chink of light at the side of our porthole. Over recent weeks there are two important things that have happened all of which give some cause of optimism.

1. Expected returns have sharply improved for investors

In recent weeks, key bond markets including UK government gilts have fallen sharply. This was of course because of fears that our government policy was rendering our finances unsustainable. Yet these falls have resulted in the expected annual return for investors in gilts today being around 3% a year over the next decade. At the start of 2022 we estimated that based upon prices then the expected return each year would be just 0.5%. These meaningful moves mean that cautious investors face a far brighter future of returns. It is true of course, that gilts have fallen because of a very real crisis. The mini-budget demonstrably tested the fragile relationship of trust between the British government and its lenders.

However, the optimistic interpretation as of today is that this crisis seems to have been averted. The government has backtracked on its plans and we may conclude that one outcome of this is that for the next 20 years, it is highly unlikely that either a Labour or a Conservative government will try this experiment again. Perhaps this means that the UK should ironically be considered safer than other developed market bond markets once the crisis abates?

2. Inflation disappointed last week but markets struggled to fall further

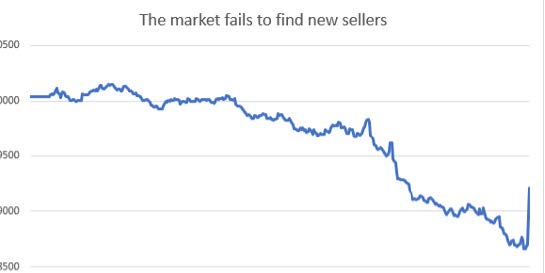

A key US inflation figure issued last week came in at 8.2%, just a little more than people expected. It is this US inflation number which will likely be the biggest driver of markets in the months ahead. This figure means that the Federal Reserve will have to continue with its aggressive interest rate rises. The immediate reaction from markets was sharp, with the Dow Jones falling by 515 points at its biggest drop. However, what was striking was that it then almost immediately recovered, rallying at its peak by 1,100 points in the same day. This is incredibly rare. It occurs when the market is struggling to find any new sellers for falling shares. In other words people seem to be ‘all sold out.’ In these situations, those people who are betting against the market have to suddenly start buying to cover the losses they are incurring. We call this a ‘short squeeze.’ An awful lot of bad news is in the price of shares now and it would take some fairly significant new bad news for them to fall much further.

Crises always resolve themselves. Like human beings markets never stay in crisis forever. Monetary policy resets, government policy changes, inflation is forced down. In the middle of it all it can feel like the storm will never pass but in reality it is storms exactly like this that create the most compelling opportunities for long-term investors.

Click Here to view our latest Market Commentary